- December 13, 2023

- In the Media

Kimley-Horn to Offer 401(k) Student Loan Repayment Match in 2024

Qualifying Employees to Receive Up to 8% of Their Salary Plus Bonus for Outstanding Student Loans from One of the Country’s Best 401(k) Plans, in Partnership with SoFi at Work

RALEIGH, N.C. (December 13, 2023) –Kimley-Horn, a premier engineering, planning, and design consultancy with offices across the country, will pay matching contributions into qualifying employees’ 401(k) plans based on their student loan repayments. In partnership with SoFi at Work, a leading provider of holistic financial well-being and education benefits to more than 1,000 organizations, the new benefit adds to one of the industry’s best financial wellness programs.

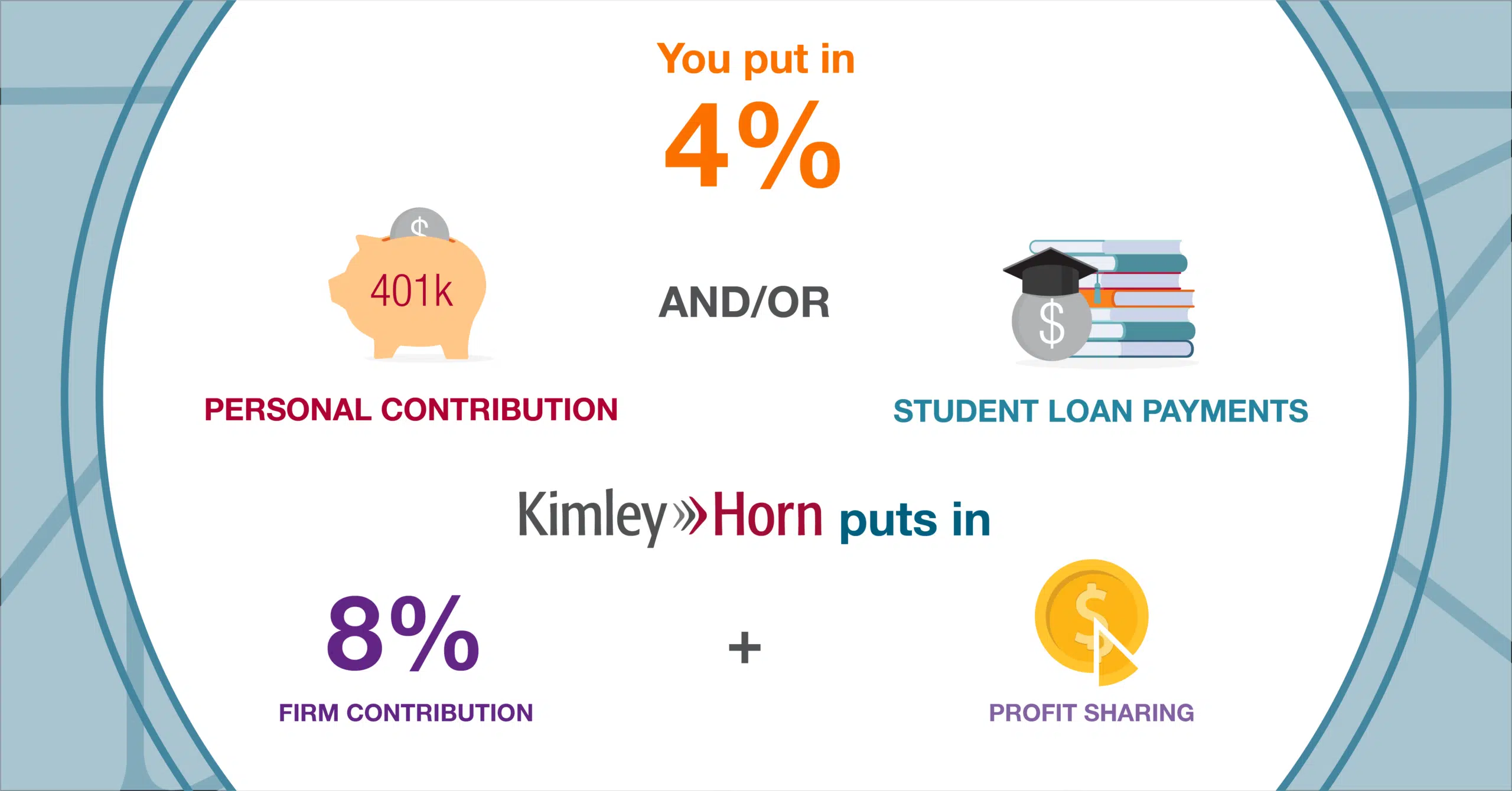

Today, after one year of employee service, Kimley-Horn has a match of double the employee’s four percent contribution with an eight percent company contribution. On January 1, 2024, employees’ student loan repayments can replace all or a portion of the four percent contribution, allowing employees to continue to receive the company’s retirement match while paying down their student loans.

In addition to the 200% match, for decades Kimley-Horn has provided an additional generous profit-sharing contribution to employees’ 401(k) plans. In most recent years, the firm has paid an additional 10% of employees’ salary plus bonus into their 401(k) plans, giving a total contribution to retirement of 18% of salary plus bonus. Employees also have free access to financial planning and advice through an independent third party.

“We always look for ways to improve our employees’ financial wellness over the long term,” said Kimberly Plessinger, Compensation and Benefits Manager at Kimley-Horn. “The ability to count student loan repayments toward 401(k) contributions lets employees both pay for the past and maximize savings for the future. Engineering and design consulting is an incredibly competitive labor market, and this further sets us apart as one of the best places to work.”

Using SoFi at Work’s innovative Student Loan Verification (SLV) service, Kimley-Horn will help its workforce pay off student debt while also maximizing its retirement savings. A provision in the Secure 2.0 Act allows companies to offer this 401(k) benefit starting in 2024. Once Kimley-Horn identifies eligible participants, SLV simplifies the rest of the process, from plan design to data security and reporting. SoFi at Work verifies the student loan payments and its 401(k) partner, T. Rowe Price, delivers the contributions for retirement matching.

“We applaud Kimley-Horn for taking these steps to respond to its employees’ needs and enhance its financial well-being program,” said Barrett Scruggs, VP of Workplace Financial Well-being at SoFi at Work. “We’re proud to collaborate with industry leaders like Kimley-Horn and T. Rowe Price and look forward to redefining the future of employee benefits through our partnership together.”

Kimley-Horn’s benefits help the firm win a slew of workplace awards. For over 15 years, Kimley-Horn has been named one of Fortune 100 Best Companies to Work For®. In addition, each year going back to 2017, Kimley-Horn has made the list for the:

- Fortune Best Workplaces for Women™

- Fortune Best Workplaces in Consulting & Professional Services™

- Fortune Best Workplaces for Millennials™

About Kimley-Horn

Kimley-Horn, one of the nation’s premier engineering, planning, and design consulting firms, serves a wide range of disciplines, including transportation, aviation, development services, energy, transit, urban design, landscape architecture, and water/wastewater. With nearly 8,000 employees in more than 125 offices nationwide, Kimley-Horn is one of Fortune’s 100 Best Companies to Work For and one of People Magazine’s Companies that Care. For more information, please visit www.kimley-horn.com. Follow Kimley-Horn on LinkedIn, Instagram, and Facebook.

About SoFi

SoFi (NASDAQ: SOFI) is a member-centric, one-stop shop for digital financial services on a mission to help people achieve financial independence to realize their ambitions. The company’s full suite of financial products and services helps its more than 6.9 million SoFi members borrow, save, spend, invest, and protect their money better by giving them fast access to the tools they need to get their money right, all in one app. SoFi also equips members with the resources they need to get ahead – like career advisors, Credentialed Financial Planners (CFP®), exclusive experiences and events, and a thriving community – on their path to financial independence.

SoFi innovates across three business segments: Lending, Financial Services – which includes SoFi Checking and Savings, SoFi Invest, SoFi Credit Card, SoFi Protect, and SoFi Insights – and Technology Platform, which offers the only end-to-end vertically integrated financial technology stack. SoFi Bank, N.A., an affiliate of SoFi, is a nationally chartered bank, regulated by the OCC and FDIC and SoFi is a bank holding company regulated by the Federal Reserve. The company is also the naming rights partner of SoFi Stadium, home of the Los Angeles Chargers and the Los Angeles Rams. For more information, visit SoFi.com or download our iOS and Android apps.