In the early 2020s, industrial outdoor storage (IOS) emerged as a solution to accommodate the increased consumer demand exacerbated by the COVID-19 pandemic and ensuing supply chain issues. At its height, the largest driver in this accelerated growth was freight—and existing buildings in the market couldn’t accommodate the volume of goods in demand. IOS became the stopgap to accommodate this surplus of goods and the trucks needed for their transportation.

As this peak has passed, the future of IOS and its projected benefits have become more malleable alongside the evolving industrial and shipping landscapes. Read on to hear about recent IOS trends and projected future changes.

Key Geographic Markets for IOS Growth: DFW and Southern California

Demand for IOS sites has grown considerably in key market areas, namely Dallas-Fort Worth (DFW) and Southern California. In DFW, one of the United States’ major transportation centers, the IOS market has grown to match the city’s rapid expansion and development in logistics and manufacturing. This has attracted businesses seeking strategic locations for warehousing and distribution, and IOS has played a crucial role in accommodating their operational needs. Certain submarkets, like Southeast Dallas, have experienced recent industrial growth due to their proximity to rail, making the IOS market a natural fit to help facilitate that surge.

In Southern California, manufacturing reshoring, global trade, and the sustained growth of e-commerce have continued to drive the need for effective storage and logistics solutions, and IOS plays a crucial role in supporting supply chains and facilitating commerce. Additionally, states with major logistics hubs like Florida, Maryland, New Jersey, and Virginia are experiencing ongoing demand for IOS, highlighting how the importance of last-mile delivery— the stage of moving goods from a transportation hub to their final destination—will continue to drive the desire for IOS.

Supporting E-commerce Growth with Ports

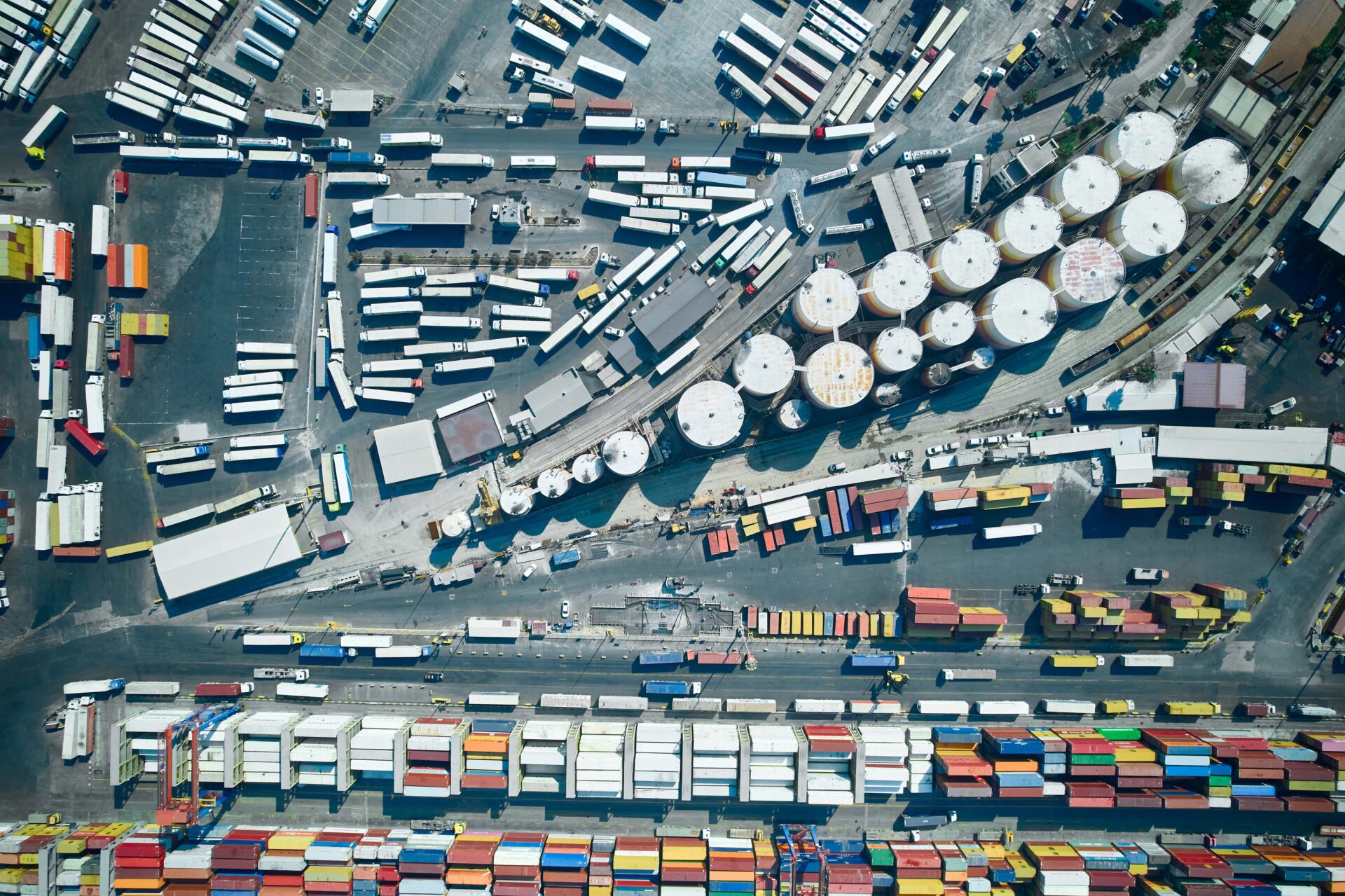

During the COVID-19 pandemic, the lack of stock and backstock led to reshoring and nearshoring conversations across the industrial industry. During this time, ports across the country improved their operations and organization to better alleviate the pressures of increased consumer demand and the resulting surplus of inventory. With better automation and scheduling, ports began to run more efficiently, lessening the need for buffer areas such as IOS.

Although the supply chain delays caused by this e-commerce boom have lessened, e-commerce has continued along with the adoption of just-in-time inventory systems to drive American shopping, manufacturing, and shipping trends—making ports a key lynchpin in the future need for IOS. E-commerce growth has led to record import volumes at US ports, increasing the demand for nearby land to help ease congestion and store containers. Demand for container storage remains high in coastal markets, particularly the Ports of Los Angeles and Long Beach.